- Digital transformation

Is your company ready? Find out what you need to know for 2026.

The Belgian government is taking a major step towards digitalisation. As of 1 January 2026, electronic invoicing via the Peppol network will be mandatory for all Belgian VAT-registered businesses carrying out B2B transactions.

But what does this really mean? And what should your company do now to prepare?

📑What is e-invoicing?

E-invoicing is more than just sending a PDF by email. It means exchanging invoices automatically and in a structured, machine-readable format (such as UBL 2.1). Your accounting or ERP system can then process invoices without manual input or scanning.

📬What is Peppol?

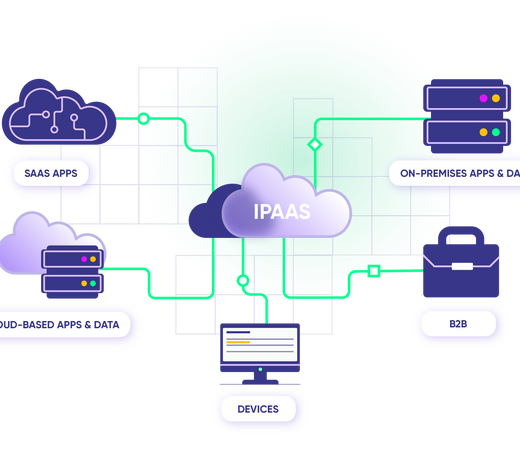

Peppol (Pan-European Public Procurement On-Line) is the standardised network that securely sends and receives these invoices between sender and recipient.

Think of it as an international digital postal service. Using a Peppol Access Point, you send and receive invoices directly from your software.

Who does this apply to?

The requirement applies to all Belgian VAT-registered businesses that issue B2B invoices.

B2C transactions are excluded.

Do you only carry out exempt activities (e.g. medical, education) or are you not established in Belgium? Then this obligation does not apply to you.

🚫 Not ready in time? That will cost you.

The Royal Decree of 14 July 2024 confirms that companies that are not technically compliant by 1 January 2026 risk fines:

• 1st offence: €1,500

• 2nd offence: €3,000

• 3rd and subsequent offences: €5,000

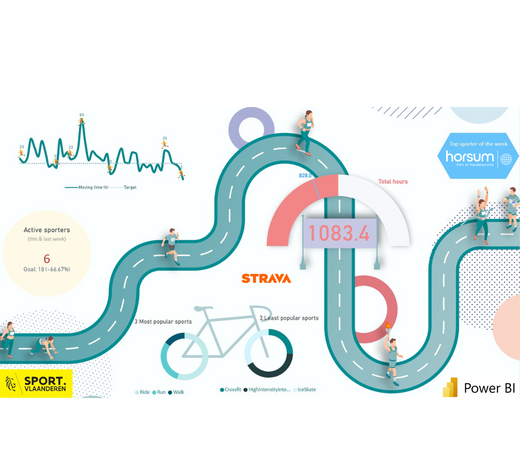

🔄How does this impact your processes?

Invoices you might currently scan or book manually will soon flow directly into your ERP or accounting system.

Processing your bookkeeping in an ERP system

To send and receive Peppol invoices, your organisation needs a Peppol Access Point — the link between your ERP/accounting software and the Peppol network. There are two main options:

1) Via your ERP or accounting software

More and more ERP and accounting packages offer native Peppol integration. This is usually activated for a one-time fee or subscription. A big plus: incoming invoices automatically land in the right approval flow or in your books.

Already using an OCR solution? In many cases, Peppol is already supported. Peppol invoices are recognised, matched and booked automatically.

Some examples:

• Blue10

• Continia Document Capture for Business Central

• OCR in Robawsbox

• Scan & Recognise in Exact Online

2) Via an external service provider

If your ERP does not support Peppol, an external Access Point provider can act as an intermediary, sending and receiving invoices for you. The link with your software is often set up using a standard plugin or API. You usually pay a monthly or annual fee, depending on the number of documents.

Many providers offer a complete two-way solution for sending and receiving Peppol invoices — no need to develop or maintain your own technical link.

Processing part of your bookkeeping in an ERP system

Many businesses split incoming invoices into goods for resale and non-goods:

• Goods for resale (e.g. stock, raw materials) are processed in the ERP system because they are part of inventory and order flows. These invoices must be linked to purchase orders, deliveries and warehouse receipts.

• Non-goods (e.g. services, IT licences, office supplies) are often booked directly in the accounting software. They do not affect stock levels and typically require a separate approval flow.

As each company may only have one active Access Point for receiving, it’s worth planning carefully. If you work with multiple systems, it usually makes sense to process all incoming invoices centrally in your ERP. This avoids losing features and keeps everything clear.

For sales invoices, there is no restriction: you can use multiple Access Points for sending. This makes it possible to run several sales solutions in parallel.

💶 Financial incentive: investing now pays off

The government is giving businesses a push to go digital.

✔️ 120% cost deduction: Small businesses, self-employed and liberal professions can deduct 120% of the costs for invoicing software and related advice. This covers subscription fees and consultancy costs, but not purchased licences. The scheme runs from 1 January 2024 to the end of 2027. Read more on this incentive: Verhoogde fiscale aftrek voor bepaalde kosten | VLAIO

✔️ Extra investment deduction: From 2025, the investment deduction for digital fixed assets (like software or IT infrastructure) will increase to 20%.

In short: a double incentive to future-proof your invoicing process now.

What can you already do?

✅ Check whether your ERP or accounting package is Peppol-ready

✅ Arrange your Peppol Access Point (via your software provider or an external service)

✅ Start testing and trial runs in 2025

✅ Organise your approval flows digitally

Conclusion: Peppol is becoming mandatory — but being prepared means less hassle, fewer fines and clear financial benefits.

👉 Any questions or want to brainstorm how to tackle this? We’re here to help.